The Artificial Intelligence Stock That Rocked Wall Street

Table of contents

Table of contents

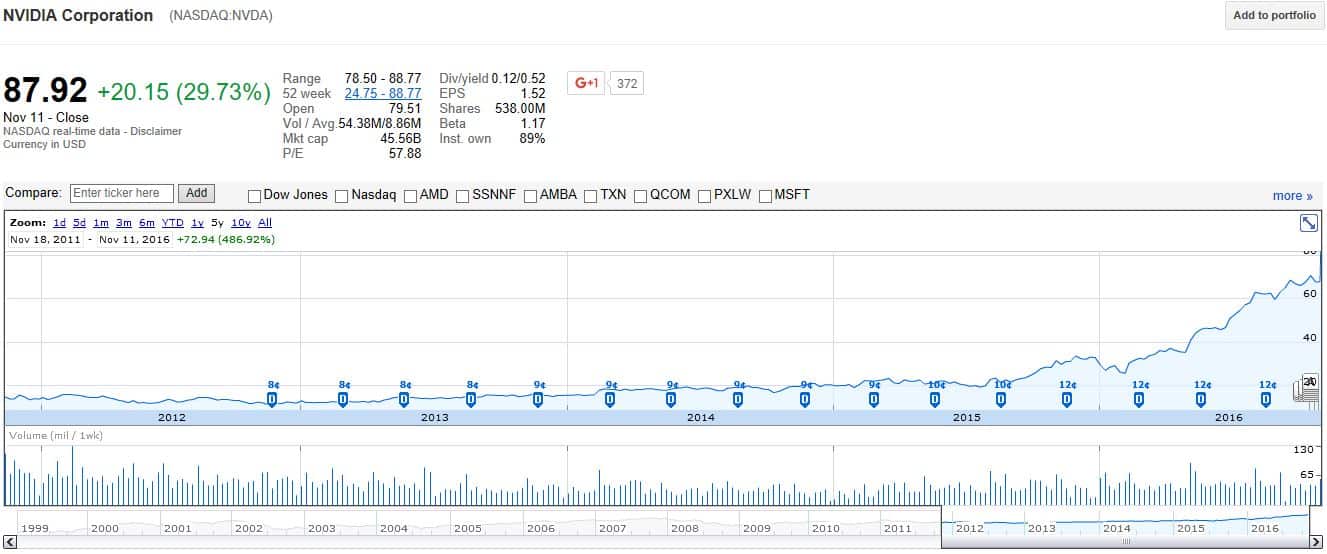

While the biggest news of this past week was the surprise results of the U.S. presidential elections, we saw something happen on Friday that was actually even more remarkable. In fact, what happened this past Friday represented the dawn of an artificial intelligence (AI) computing era which is being led by an artificial intelligence stock that rocked Wall Street with their latest earnings report. A company that we’ve been meaning to write about for a while has now emerged as the AI computing company with the financial results to back it. That company is NVIDIA Corporation (NASDAQ:NVDA) and this is what their stock price trajectory looks like:

That chart above offers up two simply incredible pieces of information. The first is that over the past 5 years, NVDA stock has returned an astounding +487% while the NASDAQ has returned just +95% over the same time frame. That’s pretty remarkable but not nearly as remarkable as NVDA’s one-year returns. In the past year alone, NVDA shares have risen +178% compared to just +2% for the NASDAQ. Now for the second piece of information which was what happened this past Friday.

In the boring world of finance, we have this theory called the “efficient market hypothesis” which simply states that all the relevant information out there should be already incorporated into the price of a stock. With big companies like NVDA, you would never expect such drastic moves upwards in share price with the exception of major corporate events like acquisitions. The fact that earnings were so strong that the stock price jumped an incredible +29.73% shows that the talking heads on Wall Street severely underestimated the potential of NVDA. What they probably didn’t see coming was the effect that the rise of AI computing would have on NVDA’s earnings report. Here’s an excerpt from the NVDA earnings report:

GeForce GPU gaming results were fueled by strong adoption of our recent Pascal™ architecture. Datacenter (including Tesla®, NVIDIA GRID™ and DGX-1™) was a record $240 million, up 193 percent year on year and up 59 percent sequentially. This reflects strong demand for deep learning training, Tesla and GRID for cloud and virtualized computing, and initial DGX-1 sales.

NVIDIA isn’t just a company that provides computing hardware to nerdy PC gamers. In a very short period of time, NVDA has reinvented their company as the leading provider of AI computing hardware for deep learning. You know how they are referring to themselves in their latest earnings report? NVIDIA (NASDAQ: NVDA) is the AI computing company. One piece of evidence that supports this is their rapidly growing AI computer chip customer base:

We do a lot of research here at Nanalyze to bring you the quality articles that get delivered weekly to your inbox and in the process of doing so, we do make investments ourselves when we find companies that interest us. We’ve remarked before that there just aren’t any pure-play artificial intelligence stocks for retail investors though that may soon change with the emergence of NVDA. (Update: it has indeed changed since the publishing of this article.) Just a few weeks ago we pulled the trigger on some NVDA stock because even though it appeared to be overpriced, we became firmly convinced that this company is quickly becoming a pure-play picks and shovels artificial intelligence stock for AI computer chips. Just look at how their website now reflects their deep commitment to AI computing:

Now look what’s happened. We want to add more shares to our position and now they’ve jumped by 30%. The point is, if you see a company that you will benefit from an emerging technology theme that you want exposure to for the long term then you should hold it and not be so concerned about entry price. NVDA is a $45 billion company that has reinvented themselves as the leading provider of AI computing hardware by offering enterprise hardware solutions like the world’s first AI supercomputer in a briefcase-sized box which delivers performance equal to 250 conventional servers:

Conclusion

We talked before about 5 different startups that are working on building AI chips. We’re pretty sure that NVDA is keeping close tabs on these companies and that they will move to shut down any competitive threats through acquisition or patent litigation. We also need to pay attention to companies like Google which is developing their own hardware for their homegrown deep learning platform called Tensorflow. The future growth of AI promises to be greater than anything we can imagine and there are plenty of room for multiple players. While we watch and wait, we’re going to think about adding more shares to our position using dollar cost averaging. NVIDIA looks like a great $45 billion picks-and-shovels play on AI computer chips and it may be the closest thing there is to a pure-play artificial intelligence stock there is at the moment.