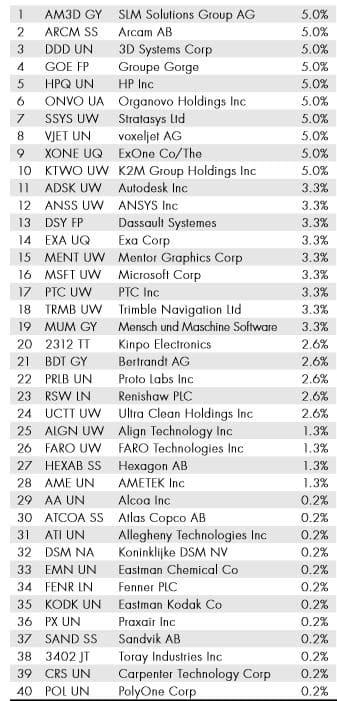

Last week, a firm called Ark Investment Management (Ark Invest) unveiled “The 3D Printing ETF (BATS:PRNT)” which is based on their proprietary “Total 3D-Printing Index”. This index is designed to track the price movements of stocks with exposure to the 3D printing industry. Let’s take a closer look at this new 3D printing ETF by first looking at the 40 stocks included in their index as seen below:

The first thing to note here is that there are 12 stocks with a weighting of just .2%. This means that the combined weighting of all 12 of these stocks is just 2.4%. To have stocks in the index with such low weightings doesn’t seem to make much sense. If one of these stocks showed a +500% return, it would still only have a weighting of 1%. These stocks have such an insignificant weighting that it makes no sense to analyze their involvement in 3D printing because they are not likely to have any meaningful impact on the ETF’s performance.

This leaves us with 28 stocks to examine. Since the top-20 stocks constitute nearly 80% of the entire portfolio, let’s just focus on these for now.

A year ago we published an article titled “Is Now the Time to Invest in 3D Printing Stocks? in which we created the Nanalyze 3D Printing Stocks motif which is a mini-ETF that contains the following popular 3D printing stocks:

![]()